3 US Growth Companies With Earnings Growth of up to 102%

As U.S. markets continue to fluctuate, and major indexes have recently fallen due to declines in technology and energy products, investors are looking closely at corporate earnings reports for clues about and potential growth opportunities. In this environment, companies with high insider ownership can be very attractive as they often demonstrate strong insider confidence and alignment with shareholder interests, making them an attractive target. for those looking for solid growth opportunities amid market volatility.

Top 10 Companies with Domestic Ownership in the United States

|

Name |

Insider Ownership |

Income Growth |

|

Atlas Energy Solutions (NYSE:AESI) |

29.1% |

40.9% |

|

GigaCloud Technology (NasdaqGM:GCT) |

25.7% |

26% |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

23.4% |

|

Victory Capital Holdings (NasdaqGS:VCTR) |

10.2% |

33.2% |

|

Super Micro Computer (NasdaqGS:SMCI) |

25.7% |

28.0% |

|

Hims & Hers Health (NYSE:HIMS) |

13.7% |

37.4% |

|

Credo Technology Group Holding (NasdaqGS:CRDO) |

14.0% |

95% |

|

EHang Holdings (NasdaqGM:EH) |

32.8% |

81.4% |

|

The Carlyle Group (NasdaqGS:CG) |

29.5% |

22% |

|

BBB Foods (NYSE:TBBB) |

22.9% |

51.2% |

Click here to see the full list of 182 stocks from our Fastest Growing US Companies with Top Insider Authority.

Let’s take a look at some notable picks from our reviewed stocks.

Wall St Growth Status Simply: ★★★★☆☆

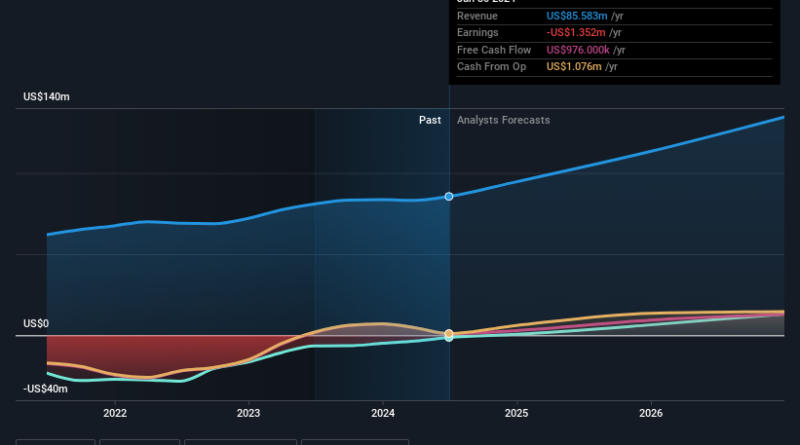

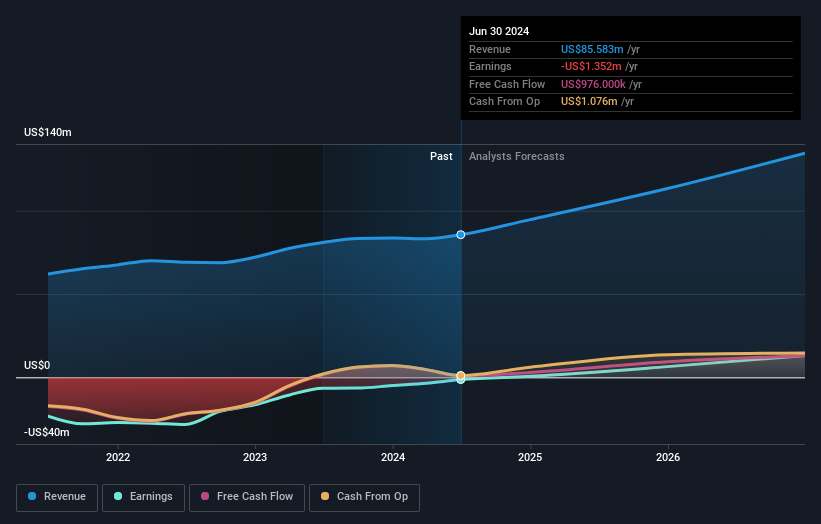

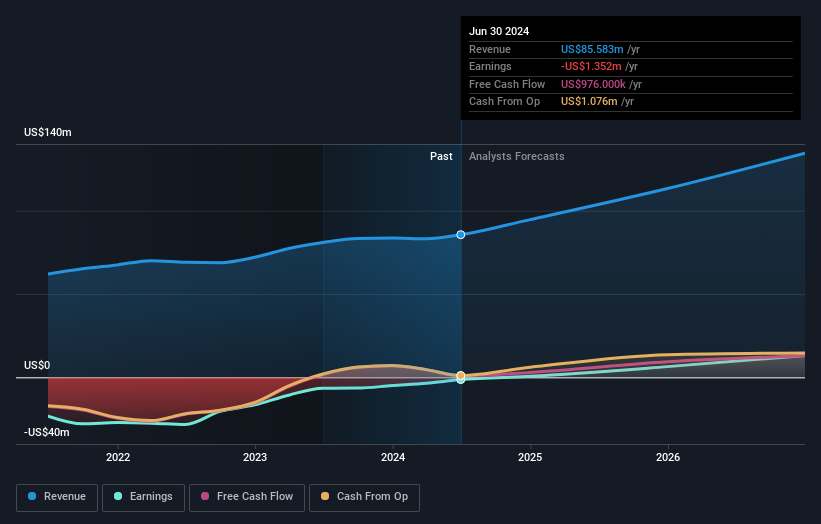

Summary: ChromaDex Corporation is a bioscience company that develops healthy aging products, with a market cap of $254.94 million.

Operation: The company’s revenue comes from three segments: Tools ($11.70 million), Consumer Products ($71.00 million), and Analytical Reference Standards and Services ($2.88 million).

Internal control: 30.7%

Earnings Growth Forecast: 102.9% pa

ChromaDex is trading at a significant discount to its estimated value, suggesting that it is possible. The company is set to grow significantly, and earnings are expected to increase by more than 100% year-on-year and revenue is expected to exceed the US market. Recent changes include the appointment of a new CFO, Ozan Pamir, who brings extensive financial expertise. Despite the lack of recent internal business activity, ChromaDex’s strategic moves and new product launch it well for future profitability.

Wall St Growth Status Simply: ★★★★★☆

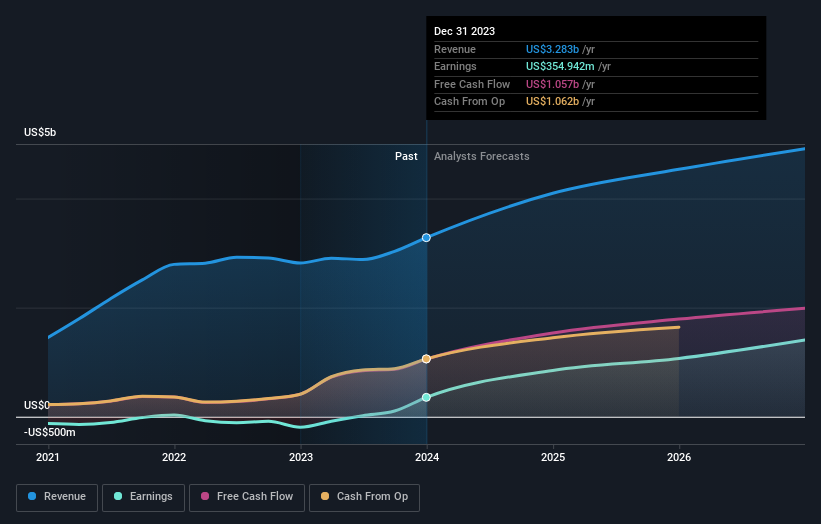

Summary: AppLovin Corporation operates a software-based platform designed to improve marketing and monetization for advertisers in the United States and internationally, with revenues of $48.07 billion.

Operation: The company’s revenue comes from two main divisions: Tools, which generates $1.49 billion, and Software Platform, which generates $2.47 billion.

Internal control: 38.3%

Earnings Growth Forecast: 24.9% pa

AppLovin is trading well below its valuation, indicating potential upside. The company predicts strong earnings growth of 24.89% annually, which exceeds the US market average. Despite high debt and recent sales performance, AppLovin’s inclusion in the FTSE All-World Index underlines the importance of the market. The latest financial performance shows strong revenue and net income growth with second quarter sales reaching US$1.08 billion compared to US$750 million last year.

Wall St Growth Status Simply: ★★★★★★

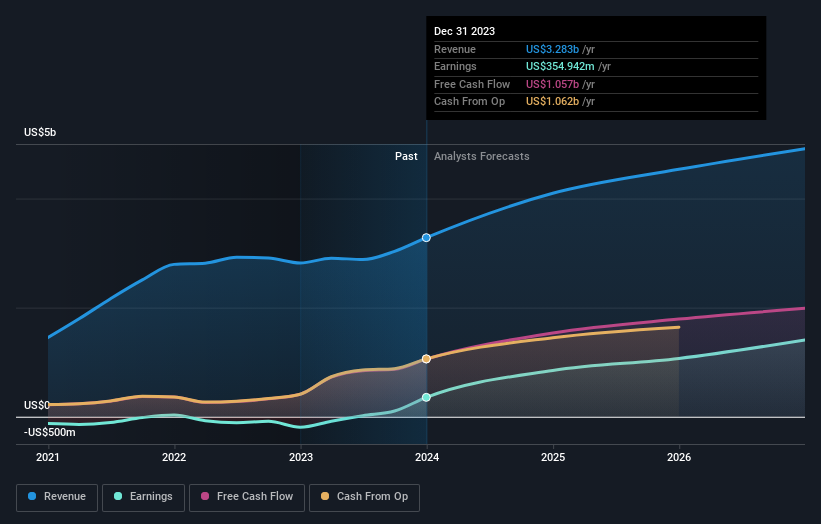

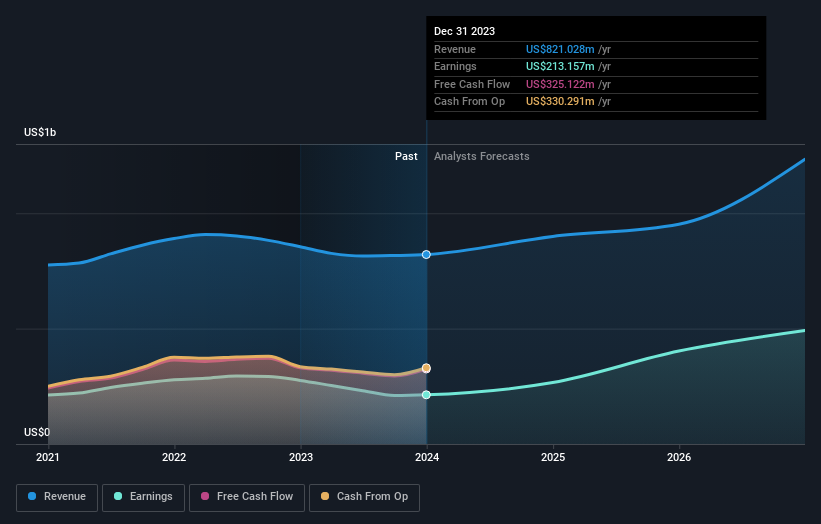

Summary: Victory Capital Holdings, Inc. operates as an asset management company in the United States and internationally, and is valued at $3.87 billion.

Operation: The company generates $850.96 million in investment management services and products.

Internal control: 10.2%

Earnings Growth Forecast: 33.2% pa

Victory Capital Holdings is trading below its fair value, suggesting potential appreciation. The company is on track for strong earnings growth at 33.2% annually, which is higher than the US market average. Despite high debt and an uncertain dividend history, recent financials show solid performance with second-quarter revenue of US$219.62 million and net income of US$74.25 million, both from last year. No significant insider trading activity has been reported recently.

Where Now?

Looking for More Opportunities?

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St does not have a position in any of the stocks mentioned. The analysis only considers stocks held directly by insiders. It does not include indirect property holdings in other vehicles such as corporations and/or trusts. All revenue estimates and earnings growth estimates quoted are at annual (annual) growth rates over a 1-3 year period.

Companies discussed in this article include NasdaqCM:CDXC NasdaqGS:APP and NasdaqGS:VCTR.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Growth #Companies #Earnings #Growth